Cryptocurrencies, such as Bitcoin and Ethereum, have experienced explosive growth in popularity over the past few years. These digital assets are decentralized, meaning they are not controlled by any government or financial institution. At the same time, they offer users a high degree of control, security while enabling them to conduct transactions fast and across multiple jurisdictions. As a result, more and more businesses and individuals are using cryptocurrencies for conducting transactions or for investment purposes.

Unfortunately, these characteristics made cryptocurrencies attractive, not only to individuals and businesses but also to criminals looking to engage in illicit activities such as money laundering, drug trafficking, and ransomware attacks.

As a result, many governments and regulatory bodies require crypto providers to implement measures to combat the abuse of cryptocurrencies for criminal purposes, including increased KYC and AML regulations and enhanced monitoring of cryptocurrency transactions.

The Unique Compliance Challenges Presented by Cryptocurrencies

The unique characteristics of cryptocurrencies, such as their decentralized nature and speed, make compliance particularly challenging for regulated entities. Here are a few challenges that crypto providers may face when trying to implement effective AML measures:

- Decentralized nature: Traditional compliance relies on information controlled by a central party i.e., a financial institution. Cryptocurrencies are decentralized, meaning they are not controlled by any central authority or financial institution. This makes it difficult to identify all parties involved in a transaction.

- Pseudonymity: Cryptocurrencies are pseudonymous. This means that the identities of the parties involved in a cryptocurrency transaction are not fully disclosed, but rather they are identified by pseudonyms or anonymous addresses. Many cryptocurrency services may be used by users to enhance anonymity, making it difficult to identify the individuals involved in a transaction or track the flow of funds.

- Lack of clear identification: Unlike traditional financial institutions, which require customers to provide clear identification, many cryptocurrency exchanges and wallets do not require users to provide detailed personal information. This makes it difficult to verify the identity of participants in a transaction.

- Rapidly changing technology: The blockchain is a rapidly evolving technology. This can make it difficult for regulators to catch up with technological developments and create laws that will regulate the current use of cryptocurrencies.

- Technical challenges: Cryptocurrencies use complex technical systems, such as the blockchain technology, which can be difficult to monitor. Ensuring compliance in this environment requires technical expertise and specialized tools that may not be available in traditional compliance frameworks.

How Crypto Providers Can Stay Compliant with Regulatory Requirements

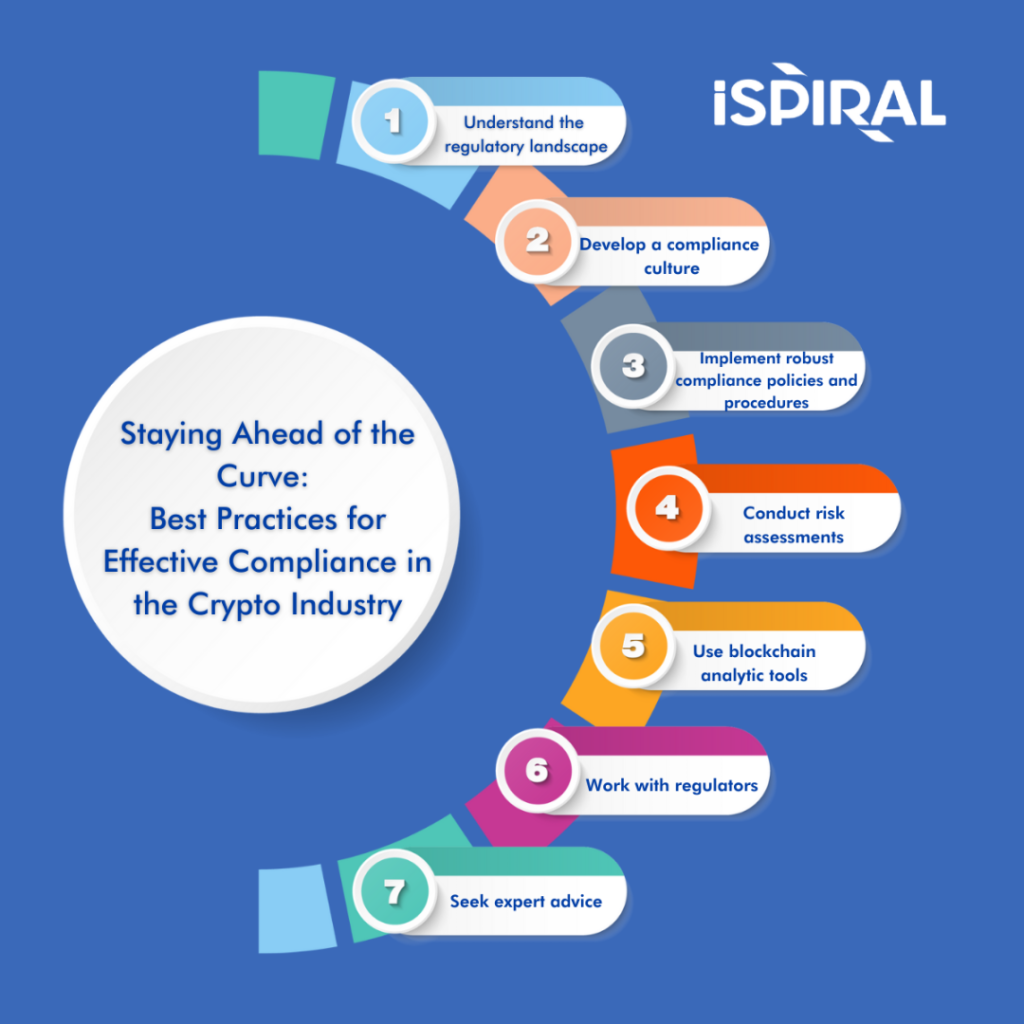

As the crypto industry continues to evolve, it’s crucial for crypto providers to keep up with changing regulatory requirements. We’ve put together a list of tips to help crypto providers stay compliant with regulatory obligations:

- Understand the regulatory landscape: Keep up to date with any regulatory developments and requirements that affect your business operations, including Know Your Customer (KYC), Anti-Money Laundering (AML), and Counter Financing of Terrorism (CFT) obligations.

- Develop a compliance culture: Foster a culture of compliance within your organization by promoting awareness of regulatory requirements and providing training to employees.

- Implement robust compliance policies and procedures: Develop internal policies and procedures that outline your compliance obligations and provide guidance to your employees. This can include KYC and AML procedures, transaction monitoring protocols, and record-keeping practices.

- Conduct risk assessments: Regularly assess the risks associated with your operations, including identifying any potential money laundering or terrorist financing risks.

- Use blockchain analytics tools: Employ blockchain analytics tools to monitor transactions and identify any suspicious activity. This can help to detect and prevent money laundering and other illegal activities.

- Work with regulators: Engage with regulators and maintain open lines of communication to ensure that you are complying with all relevant regulatory requirements.

- Seek expert advice: Consult with compliance experts and legal professionals to ensure that you have a thorough understanding of the regulatory landscape and are meeting all relevant compliance obligations.

By following these tips, crypto providers can help ensure that they stay compliant with regulatory requirements and minimize their risk of regulatory sanctions or other legal consequences.