Be KYC & AML Compliant with minimum effort.

Strengthen your ability to comply with an award-winning Unified on-premise platform to automate your Onboarding, KYC, and AML Transaction Monitoring with huge experience on Forex and Electronic Money Institutions.

Risk Ranking and Scoring doesn’t get any faster than Real-Time!

Find out how our AML Transaction Monitoring module can help you amplify your monitoring capabilities

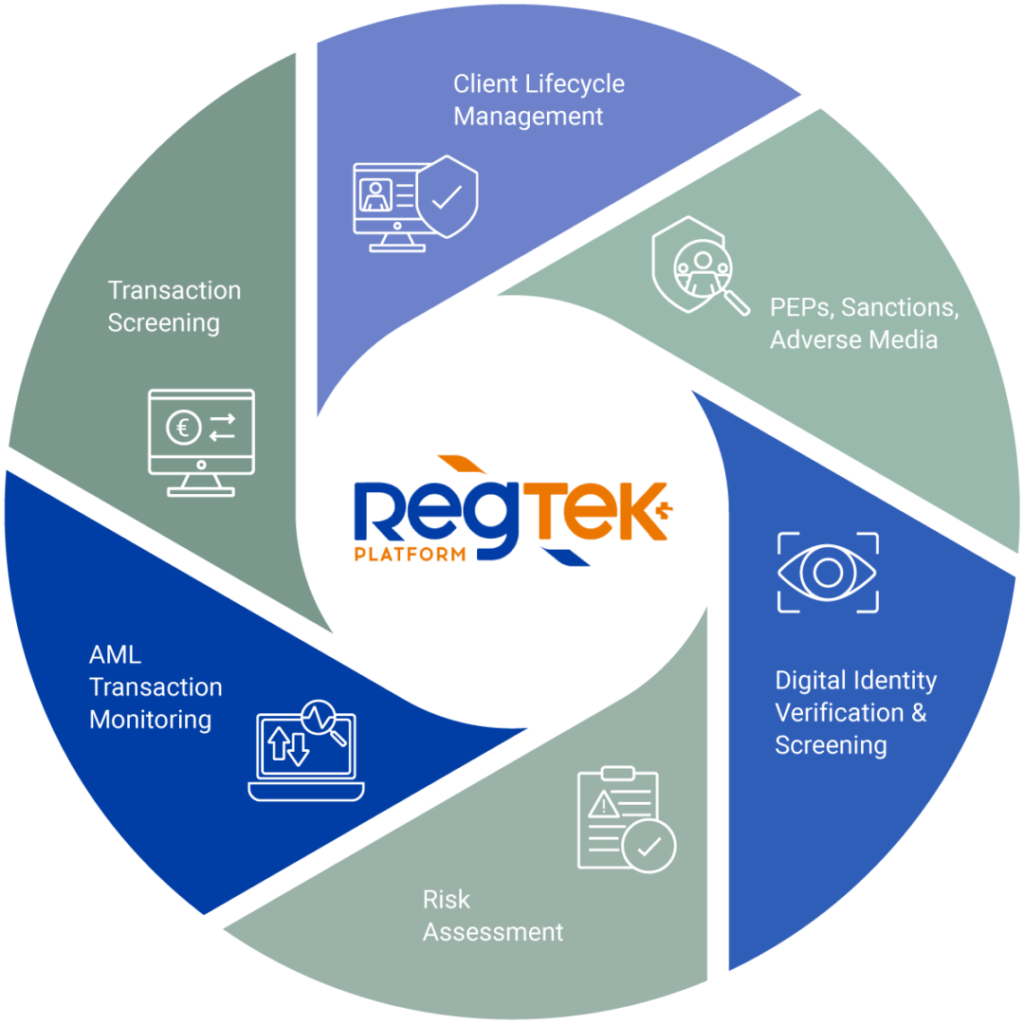

Our KYC & AML Solutions

Client Lifecycle Management

Offer the best onboarding journey to both your clients and Compliance Officers. Earn a positive first impression. More about Client Lifecycle Management

Risk Assessment

Score the AML risk exposure of your clients and meet compliance commitments across multiple jurisdictions. More about Risk Assessment

Transaction Monitoring & Screening

Detect/identify irregular behaviours on client's transactions with rule engine and machine learning models.

More about Transaction Monitoring &

Transaction Screening

Digital Identity Verification

Real time access to hundreds of global KYC data sources using an integrated API or web portal. More about Digital Identity Verification

Clients that trust us

12

countries

25+

partners

350+

clients

10.000+

users

Why RegTek+

- A Unified/All-in-One KYC & AML Solution.

- Global KYC Compliance via hundreds of Data sources.

- Regulatory Rules Engine.

- Centralized Compliance and Case repository with real time monitoring.

- Peace of mind for you with true compliance.

- Seamless onboarding and ongoing monitoring.

- Easy parameterization, risk -based approach.

AML KYC Compliance Service Online

Sectors

We understand the complex nature of Banks and other Financial Institutions and we simplify their processes by revolutionizing compliance and automating onboarding.

iSPIRAL assists Investment firms to tackle key client compliance challenges by using automation.

Trusted by the top global forex brokers, iSPIRAL assists to automate their compliance processes, and stay up to date with the latest regulations in multi jurisdictions by using machine learning and BI Analytics driven solutions.

We specialize in helping Payment firms onboard efficiently prospects and perform instant global compliance by utilizing hundreds of KYC data sources.

iSPIRAL is selected by several Insurance firms to deliver its onboarding processes and address fraud and financial crime obligations that occur in the sector.

iSPIRAL fully understands the challenges of gaming and gambling firms as they face the challenge of both AML and KYC. For that reason, our RegTek+ solution helps them comply, while reducing costs and increasing productivity.

Client Stories

XM Trading Point

XM is an established international forex broker firm and a true industry leader. XM chose iSPIRAL to address its compliance obligations and at the same time maximizing productivity.

News/Blog

Looking for a good read? Our articles offer both insightful information and a view on what is happening right now. A good read is just a click away!

Cryptocurrencies: An Avenue for Sanctions Evasion?

In recent years, the rise in cryptocurrencies’ popularity within the financial sphere has illuminated concerns about their potential misuse in evading sanctions. The decentralized nature

‘Bring Your Kid to Work Day’ 2023: Where iMATTER and Innovation Intersect

Fostering Future Innovators at iSPIRAL On August 31, 2023, iSPIRAL rolled out the red carpet for our most anticipated guests of the year – our

Debanking of PEPs – The Case of Nigel Farage

Data reveals that UK banks are closing over 1,000 accounts daily (Source: “The Guardian”). Why? They often use a tactic called “debanking”. This practice means

Testimonials

Awards and Accreditations