Once upon a time, client onboarding was a lengthy, tedious process. Carried out manually, it involved endless checks and re-checks. A study by Forrester Consulting has even suggested that the process took up to 34 weeks for financial institutions who were manually onboarding their clients!

The fragmented nature of manual onboarding (which might include everything from sales to compliance, credit, legal and back-office operations) also led to rocketing costs, which in turn varied hugely according to a specific client’s risk rating and applicability to regulations.

THE ADVANTAGES OF AUTOMATION

Today, of course, any company operating in the competitive financial market appreciates the value of automated onboarding. Over the last few years, state-of-the-art software and machine learning have led to an entirely new era, exponentially improving the onboarding process. And with COVID-19 restrictions curtailing physical business actions around the globe, digital onboarding has now become now not just the norm – it’s a must!

An ever-evolving process, onboarding now requires ongoing adaption to changes in regulations, consumer needs and market trends – something that just cannot be handled by human staff. Instead, the use of automated onboarding ensures that any organisation in the financial sector is able to provide their clientele with a seamlessly accessible journey.

A CHANGING MARKET

Automated onboarding may have begun with the younger customer, but it’s here to stay. In the past, as the digitisation of identity verification processes took off, it played right into the wheelhouse of youthful consumer groups who were fully engaged with technology.

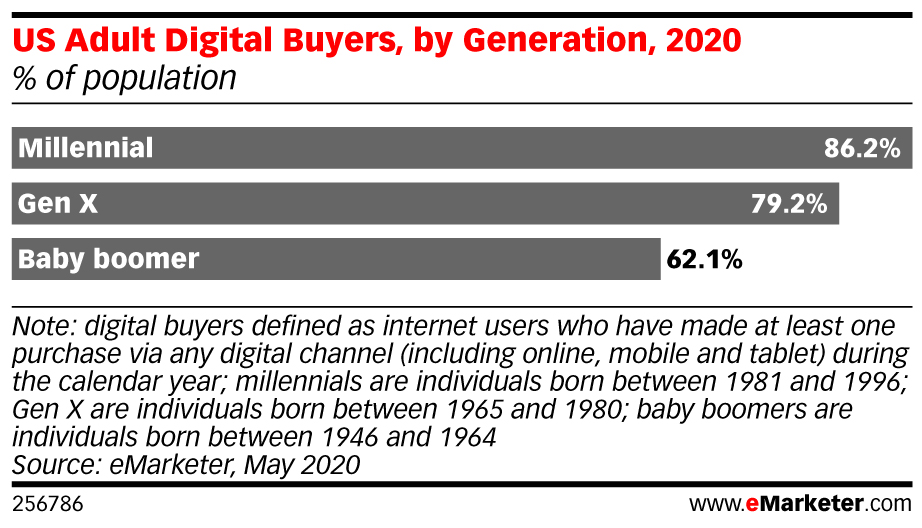

In time, other sectors of the market began to catch up. And today, we’re seeing a real change in our consumers’ perception of digital services. According to eMarketer.com, in 2020 adult digital buyer percentages spiked, with the most notable increase seen in the older age groups: 62.1% of Baby Boomers now identify as digital buyers, mainly due to the corona crisis.

COVID-19: DRIVING DIGITAL INNOVATION

Of course this worldwide pandemic has played more than small part in the adoption of digital onboarding. At a time where leaving the house requires a mask, and queuing in a busy office creates risk and uncertainty, digital services have become the norm. And organisations worldwide have welcomed the innovation of digital client onboarding.

This has, of course, led to thousands of clients choosing to digitally onboard – many of whom are entirely unused to the technology the process entails. And that means what is most needed by any financial services organisation is software that can both digitally onboard clients at speed (while ensuring all risk factors are mitigated, and due diligence is thorough and complete) and is also pleasantly user-friendly.

REDEFINING CLIENT ONBOARDING

Leading software solution company iSPIRAL has created just such technology with their innovative RegTek+ Platform. An ideal solution to financial organisations who are seeing soaring numbers of potential clients, the Platform entirely redefines the way in which businesses onboard.

Delivering breakthrough Client Onboarding which includes dynamic questionnaires, list of documents to be uploaded, and parameters which must be set for risk rating, the RegTek+ Platform offers financial institutions a best-in-class client experience for video identification, document verification, face matching and advanced digital signature.

In short, the RegTek+ Platform delivers a dedicated, automated, and seamless solution to mitigating the risks associated with onboarding. And at a time when the world is experiencing such rapid and complete change, such pioneering software is no longer a time- and cost-saving alternative to the lengthy manual onboarding process…

It is now, quite simply, absolutely and completely crucial to the survival of financial sector organisations.