Resources

Discover the latest compliance updates and documents

Filter by resource type:

Transaction Monitoring Best Practices

Transaction Monitoring is an essential component of an effective anti-money laundering (#AML) program, helping financial institutions detect and prevent illicit activities. However, with increasing volumes

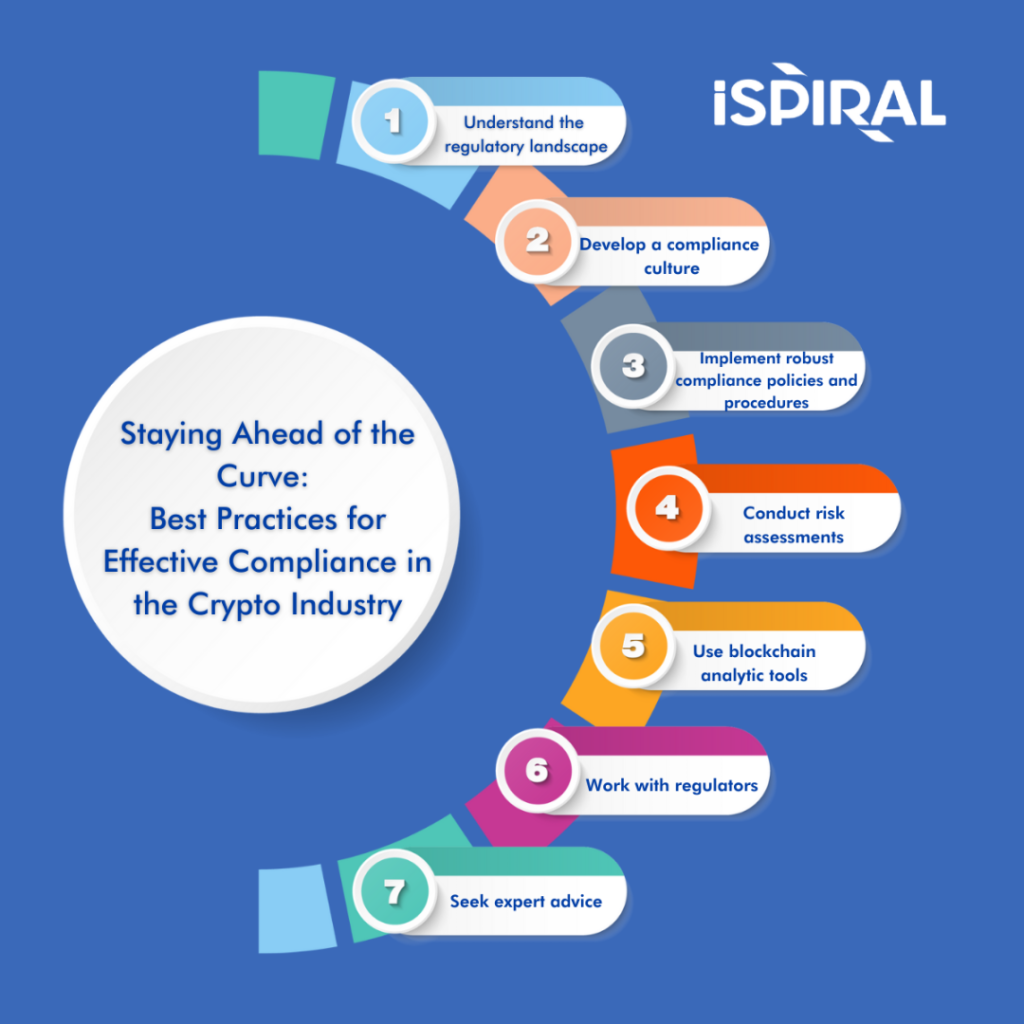

Staying Ahead of the Curve: Best Practices for Effective Compliance in the Crypto Industry

Cryptocurrencies, such as Bitcoin and Ethereum, have experienced explosive growth in popularity over the past few years. These digital assets are decentralized, meaning they are

The New AML Measures – What to Expect?

The Members of the European Parliament (MEPs) have approved new measures to prevent money laundering and terrorism financing in the European Union (EU). This development

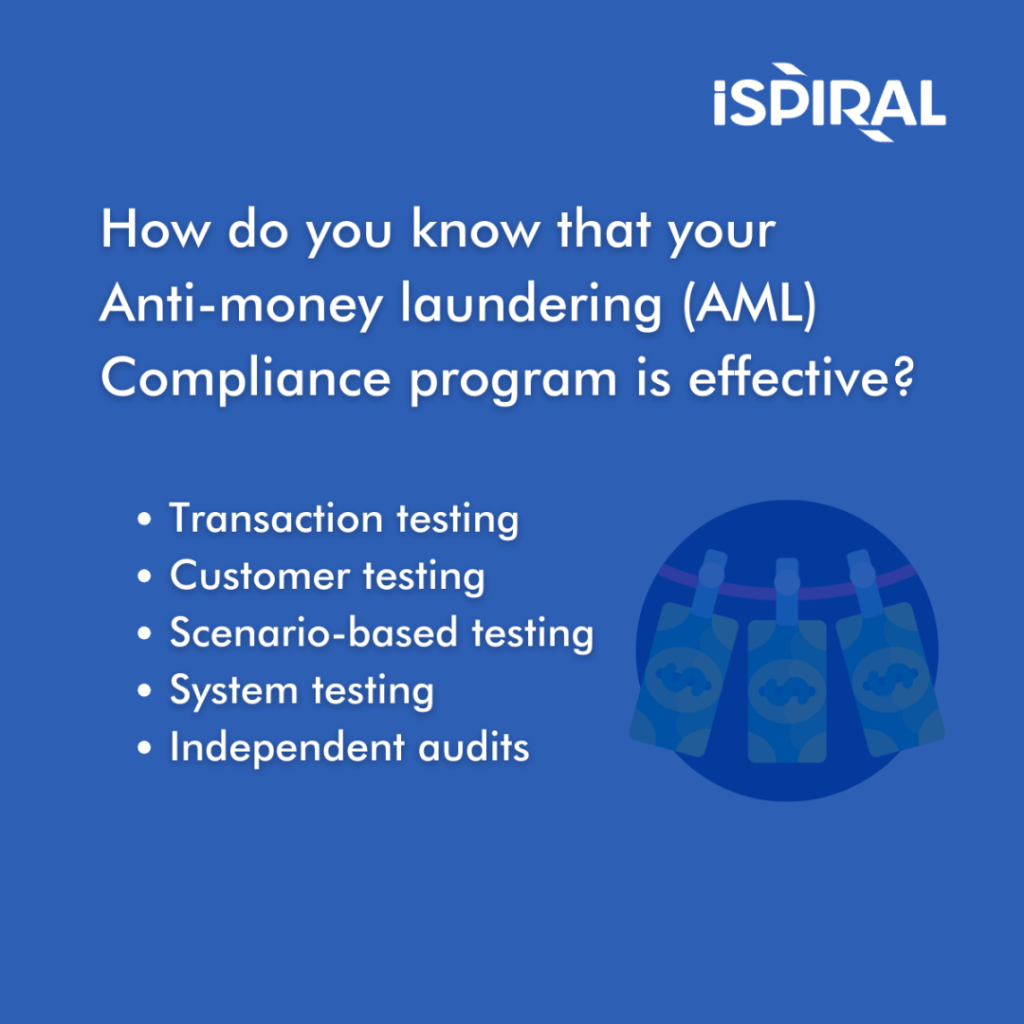

How do you know that your Anti-money laundering (AML) Compliance program is effective?

Transaction testing:How it is conducted ➡ Reviewing a sample of transactions to identify potential instances of money laundering or terrorist financing.Purpose 👉 To identify weaknesses

Protecting your Business from #moneylaundering: high-risk customers

Money laundering is a major concern for businesses of all sizes, and high-risk customers are a particular area of concern. High-risk customers are those who

Financial Crime risks in the forex trading

Financial Crime in Forex Trading: Understanding and Mitigating Risks Financial crime in Forex trading represents a significant challenge, encompassing fraud, money laundering, and market abuse. Annually, the

4 areas to focus before onboarding a client

To protect your business and ensure that you are working with clients who are not involved in financial crime during the onboarding process, it is

Navigating the OFAC 50% Rule: What Businesses Need to Know

The OFAC 50% Rule is a guideline used by the Office of Foreign Assets Control (OFAC) of the US Department of Treasury to determine whether

Uncovering the Hidden World of Money Laundering in the Art Industry

The art industry may seem like an unlikely place for money laundering, but the truth is, it’s a prime target for criminals looking to conceal